A guarantor plays a critical role in property management, especially when tenants face financial uncertainties. Property owners and tenants need to be able to define what a guarantor is on a lease, the meaning, and the roles. This is crucial for smooth rental agreements. This article will break down the guarantor definition and their role in a lease agreement.

(Also read: Understanding the Role of a Cosigner in Property Management).

What Is a Guarantor?

What is a guarantor? A guarantor is a person or an organization that agrees to be legally responsible for someone else’s debt, obligation, or performance if the person fails to fulfill them. If someone can't pay a loan, rent, or meet a contract, a guarantor is the person or organization that promises to pay or fulfill the obligation on their behalf.

Common Situations Where a Guarantor is Needed:

There are many common situations where a guarantor is needed, but these few stand out. Some common situations include:

- Loans: A bank might ask for a guarantee if the borrower has little credit history or low income.

- Renting Property: Landlords may require someone to stand in if the tenant has no steady income or is a student.

- Business Deals: In contracts or business loans, a guarantor backs up one party to reassure the other.

- Job Employment: Some organizations in Alabama require some employees to have a guarantor. The person is needed to ensure someone takes responsibility for the staff in the case of bad conduct.

(Read what rental property KPIs are and why you should track them).

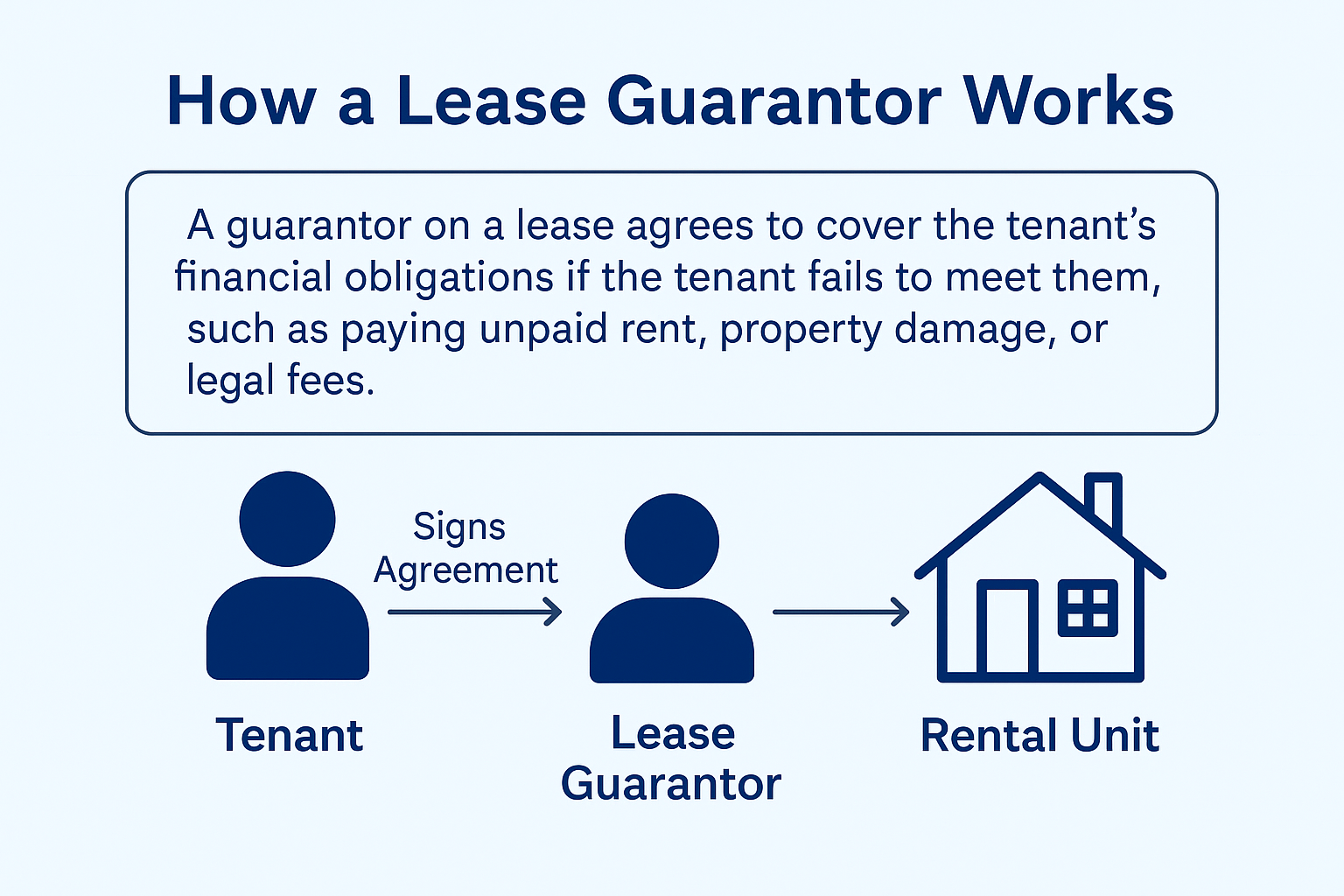

What is a Guarantor on a Lease?

A guarantor on a lease is someone who agrees to pay the rent and other financial obligations if the tenant fails to pay them. Guarantors on a lease are a financial safety net for landlords, especially when a tenant lacks a strong credit history or stable income. Apartment owners often require a guarantor for a lease when a tenant has a low credit score, no rental history, or irregular income.

| Guarantor on a Lease | Tenant |

|---|---|

| Pays if the tenant defaults on the lease | Pays the monthly rent |

| Doesn’t live in an apartment | Lives in an apartment |

| Strong credit required | May have weak credit |

(Read essential property maintenance tasks to know about in North Alabama.)

What is Required to be a Guarantor on a Lease?

To be a guarantor on a lease, you must meet certain financial and legal requirements. A person typically needs:

- Good credit history.

- Stable income or proof of income.

- Proof of Employment: Payslips, tax returns, or employment letter.

- Low Debt-to-Income Ratio: To prove financial reliability.

- U.S. Citizenship or Legal Residency: In most cases.

- A willingness to accept legal responsibility for the lease.

_1.png)

Who is a Guarantor?

A guarantor is not a resident of the rental unit. Instead, they sign an agreement pledging to cover financial duties. Some of these duties are typically rent, utility bills, or property damages. If the primary tenant fails to do these, the person who is a guarantor will have to do it.

How You Can Get a Guarantor

People who can be a guarantor are usually people close to the tenant or who know them well. There is hardly a case where a stranger acts as one. It is not advisable to take up this role for someone you don't know very well. Even if you know the person, you should make sure you can trust them before signing a guarantee for them. Some of the people who can easily act as a guarantor for a tenant are:

- Parents of college students

- Friends with a strong credit profile

- Legal guardians or spouses

As a landlord, make sure the guarantor provides documentation, including income proof, employment verification, and credit history.

(Read how to conduct a thorough property inspection without upsetting the tenants)

What are the Roles and responsibilities of a Guarantor

A guarantor is legally responsible for covering the tenant’s obligations if the tenant fails to meet them. This role comes with serious financial and legal duties.

Key Responsibilities of Guarantors:

- Pay Unpaid Rent: If the tenant misses rent, they must pay the full amount.

- Cover Property Damage: Responsible for damages beyond the security deposit.

- Handle Legal Fees: May be liable for costs if the landlord takes legal action.

- Maintain the Lease Terms: Ensures the tenant upholds lease terms like timely rent and property care.

- Remain Bound Until Lease Ends: Obligations last until the lease (or renewal) expires — unless otherwise specified.

(Read how to become a real estate investor)

What Is a Guarantor for an Apartment?

A guarantor for an apartment is a person who has agreed to pay the rent and other expenses if the tenant fails to pay them. The guarantor co-signs the lease, making them responsible for the tenant's financial obligations, such as unpaid rent, legal fees, or property damages. A guarantor for an apartment does not have the right to live in the rental property. They are only responsible for the tenant's financial obligations, such as unpaid rent, legal fees, and sometimes property damages.

(Also read: All You Need To Know About Alabama Lease Agreement and Rental Agreement Form)

Why Will a Lease Require a Guarantor for an Apartment

Landlords will require a guarantor for an apartment if the tenant does not meet the financial requirements to rent the apartment. Landlords use apartment guarantors to reduce risk when renting to tenants with low income or no credit history. These are some of the reasons a lease may require an apartment guarantor:

- The tenant has a low income

- The tenant has no rental history

- When the tenant is a student or a first-time renter

- Or the tenant has a poor credit score

(Also read: How does sublease work)

How Does a Guarantor Agreement Work?

A guarantor agreement works as a safety net for the landlord in property management. If the tenant fails to pay rent, the guarantor must legally pay. Before they sign the lease, the guarantor should understand the obligations and the risks involved.

Guarantor Agreement?

A guarantor agreement is a legal document that outlines the guarantor’s financial responsibility if the tenant fails to meet the lease terms. It includes the terms of engagement, the timeframe, and the conditions for the Guarantor to get out of the lease.

How the Guarantor Agreement Works:

Tenant Applies for a Lease:

The tenant will need to first apply for the lease. If they don’t meet credit or income requirements, the landlord may request a guarantor.

Guarantor Information:

Guarantor information refers to the personal, financial, and legal details provided by a guarantor when supporting a lease or loan application. This information is used by landlords or lenders to verify the guarantor’s identity, financial strength, and legal readiness to assume liability. It is after the guarantor's information is collected and vetted that the guarantor can be accepted.

Agreement is Signed:

In some cases, the guarantor signs a separate legal document. In other cases, they co-sign the lease. Before signing, it is expected that to has read through the document carefully and must trust the tenant.

Lease Begins:

The lease term begins after the guarantor has signed the lease agreement and the first payment has been made. The tenant lives in the property, while the guarantor is legally responsible for any missed rent, damage, or legal costs.

Liability Ends When the Lease Ends:

The guarantor’s responsibility ends when the lease expires, unless renewed or extended. He or she can also pull out, depending on the lease agreement.

Pros and Cons of Being a Guarantor on a Lease

Being a guarantor comes with significant financial responsibility. Before agreeing to this role, it’s essential to weigh the pros and cons of being a guarantor.

Pros of Being a Guarantor:

- Helping a Loved One: You can assist a family member or friend to secure a house.

- Limited Time Commitment: A guarantor is typically needed only during the lease term.

Cons of Being a Guarantor:

- Financial Risk: If the tenant defaults, the guarantor is liable for rent and damages.

- Credit Impact: Unpaid rent could negatively impact the guarantor’s credit score.

- Legal Obligations: A guarantor is bound to the lease by law and may face legal action if they fail to fulfill their duties.

(Read on is outsourcing your tenants' screening process is a good idea)

The Benefits of Having a Guarantor as a Tenant

For tenants, having a guarantor can make it easier to secure a rental, especially if you have a low credit score or no rental history. You might have asked, "Why do I need a guarantor to rent as a tenant? When your records can't get you an apartment, then you need a guarantor. Here are some of the benefits of having a guarantor:

Increased Rental Options:

When a tenant has a guarantor with a strong credit score, more landlords will be willing to rent to the tenant. This is because they will be certain that they can get their rent regardless.

Better Lease Terms:

A guarantor can lead to more favorable lease terms. For example, you may be able to negotiate a lower security deposit with a guarantor as a tenant.

Building Rental History:

With the help of a guarantor, tenants can build a solid rental history. They can then improve their chances of a future lease without a guarantor service.

Reduced Financial Burden:

When you have a guarantor, the financial burden or pressure on you drops. You can calmly work things out and fulfill your duty without pressure

Benefits of a Guarantor to a Property Owner

For landlords, having a guarantor on the lease is like having rent insurance without the monthly premium. It ensures that if the tenant fails, someone reliable will cover the costs. These are some of the benefits of a guarantor for a property owner:

Guaranteed Rent Payments

A guarantor provides a financial backup. If the tenant misses payments, they step in to cover rent, reducing the risk of income loss.

Reduced Tenant Risk

Landlords can confidently approve applicants with weak credit, no income history, or first-time renters, because a guarantor offsets that risk. This will help get apartments occupied quickly.

Stronger Legal Position

If issues arise (e.g., default, damages, eviction), landlords have two parties legally responsible: the tenant and the guarantor. This will increase enforceability and collection chances.

Lower Vacancy Rates

Guarantors allow landlords to accept more applicants, speeding up leasing decisions and reducing vacant days.

Minimized Evictions

When tenants know someone else is financially liable, they are more likely to honor the lease, preventing default and reducing eviction filings.

Peace of Mind for High-Risk Tenants

Students, freelancers, or new-to-country renters may lack credit or proof of income. A guarantor fills that gap without denying housing opportunities.

Higher Applicant Pool

Landlords who accept guarantors can attract a wider pool of applicants, especially in competitive rental markets or university areas.

(Also read: Foreclosure; Everything You Need to Know as a House Owner, a Lender, or an Investor)

What Happens if a Lease Guarantor Defaults?

If a guarantor defaults and fails to meet their financial commitments, it can lead to serious issues. The property owner may take legal actions, including:

- Garnishing wages

- They can place liens on the guarantor’s property

- They can report missed payments to credit bureaus

These actions can greatly impact their financial standing and credit score.

(Read why you should consider investing in Florence, Alabama)

Can You Get Out of Being a Guarantor?

It is hard but not impossible to get out of being a guarantor. Two main processes exist to exit the agreement.

- The tenant must meet the landlord's financial demands.

- Or the tenant finds another guarantor to replace the current one.

Additionally, some agreements specify conditions under which the guarantor can be released. Some are when the tenant proves that they can pay the bills on their own.

(Read property management vs self-management)

Conclusion: Is a Guarantor Right for You?

Understanding the role of a guarantor in property management is essential for both tenants and landlords. Guarantors provide an extra layer of security. They ensure rent and other obligations are covered if the tenant defaults.

If you're considering becoming a guarantor, make sure you fully understand the legal and financial implications involved. This is also a piece of good advice for anyone requiring one for their rental property.

Stutts Property Management has established itself as the central property management company in the whole of North Alabama. We can help you manage your properties in the Shoals area and anywhere else in Alabama. Contact us today or explore more on our blog.

(Read 100 bedroom wall decor ideas)

Frequently Asked Questions (FAQs) on the Role of a Guarantor on a Lease in Property Management

Can a Guarantor Be Removed From the Lease?

Once a guarantor has signed the lease, it is difficult to remove them unless both the landlord and the tenant agree. This is possible if the tenant’s financial state improves with proof of income. They can then bargain with the landlord to release the guarantor from their deal. This process will need the tenant to prove they can meet the financial demands on their own.

(Also read: Breaking a Lease: What You Need to Know)

Do You Always Need Guarantors?

Not every tenant requires a guarantor. Generally, guarantors are crucial when a tenant doesn’t meet the standard financial requirements set by the landlord. This could include:

- Low credit score

- Insufficient income

- No rental history

If you can meet the landlord’s financial conditions on your own, a guarantor may not be needed

What does a guarantor on a lease agreement mean?

A guarantor promises to pay the rent or adhere to the lease terms if the tenant doesn’t fulfill their obligations. This gives the landlord extra security in case the tenant defaults.

What is the qualification of a guarantor on a lease?

A guarantor is usually a person with solid credit or financial standing, such as a family member, friend, or even an organization that agrees to back the lease.

What rights does a guarantor have on a lease?

A guarantor has the right to be notified if the tenant stops paying rent. However, the guarantor does not have the right to reside in the property, as they are not a tenant.

How do I become a guarantor for a lease?

To become a guarantor, you will need to sign an agreement with the landlord, committing to cover the rent or any damages if the tenant fails to pay.

Can a guarantor be released from a lease?

Yes, a guarantor can be released if the landlord agrees or if the tenant fulfills certain conditions, such as making timely rent payments for a specified period.

What happens if a guarantor does not fulfill their obligations?

If the guarantor does not fulfill their obligations, the landlord may pursue legal action to recover unpaid rent or damages.

Can a guarantor have their own lease?

Yes, a guarantor can have their own lease. However, their financial responsibilities under the existing lease may impact their ability to guarantee another.

Can a guarantor negotiate the terms of the lease agreement?

A guarantor usually cannot modify the terms of the lease. However, they may be able to negotiate their specific financial responsibilities before signing the agreement.

What is the role of a guarantor in a student rental agreement?

In student rentals, a guarantor is often required since students may lack a stable income or sufficient credit history. The guarantor agrees to cover the rent if the student fails to pay.

How does a guarantor’s credit affect a lease agreement?

A guarantor’s credit plays a significant role, as it increases the likelihood that the landlord will accept the guarantor’s offer. A strong credit history suggests the guarantor is more likely to pay if needed.

Can a landlord require multiple guarantors on a lease?

Yes, particularly if the tenant has poor credit or a low income. Multiple guarantors provide the landlord with extra security and reduce the risk of non-payment.

How long is a guarantor liable for a lease?

Typically, a guarantor is responsible for the lease until it ends. However, they may be released earlier if the tenant moves out or the lease is terminated.

What information do landlords typically request from a guarantor?

Landlords usually ask for personal identification, proof of income, credit history, and contact details to assess the guarantor’s financial ability to meet the lease obligations.

Can a guarantor’s liability be limited?

Yes, the liability can be limited to specific costs, such as unpaid rent or property damage, depending on the terms outlined in the lease agreement.

What should a guarantor consider before agreeing to a lease?

Before agreeing to be a guarantor, individuals should ensure they can financially handle the rent and potential damages. It’s essential to read the lease carefully and understand the scope of the financial responsibility.

Is it possible for a guarantor to negotiate the amount of responsibility they take on?

Yes, a guarantor can negotiate the terms and their financial responsibilities before signing the agreement, especially if the tenant is considered high-risk. After signing, the guarantor is legally bound by the agreed-upon terms.

Do guarantors sign the lease?

Not always. They often sign a separate agreement called a "guarantor form" or "guarantee clause." However, some leases include the guarantor directly.

Does a Guarantor Have to Sign the Lease?

No, not all guarantors sign the main lease document. Instead, they often sign a separate guarantor agreement that binds them legally to the lease terms if the tenant defaults.

In some jurisdictions, guarantors may be listed on the lease or addendum, especially if required by law or policy.

What Is a Lease Guarantee?

A lease guarantee is the financial assurance provided by a guarantor to the landlord that rent will be paid on time. It's not insurance but rather a legal obligation accepted by the guarantor.

Guarantor vs. Co-Signer: What’s the Difference?

Here is a simple way to differentiate a Guarantor Vs Co-signer. Choose a co-signer if both parties intend to live in the unit. Use a guarantor when the tenant alone will occupy the property.

| Aspect | Guarantor | Co-Signer |

|---|---|---|

| Legal Role | Only pays if the tenant defaults | Shares equal responsibility |

| On Lease? | Often, a separate agreement | Usually listed on the lease |

| Credit Checks | Required | Required |

| Common Usage | Student housing, low-credit renters | Couples, joint applicants |