A cosigner plays a crucial role in the rental process, especially for tenants with less-than-ideal financial backgrounds. Understanding the role of a co-signer is vital if you are a tenant struggling to meet rental conditions. This is also important for a property owner in need of security.

(read: Tenant Background Check You Need To Carry On Your Potential Tenants)

What is a Cosigner

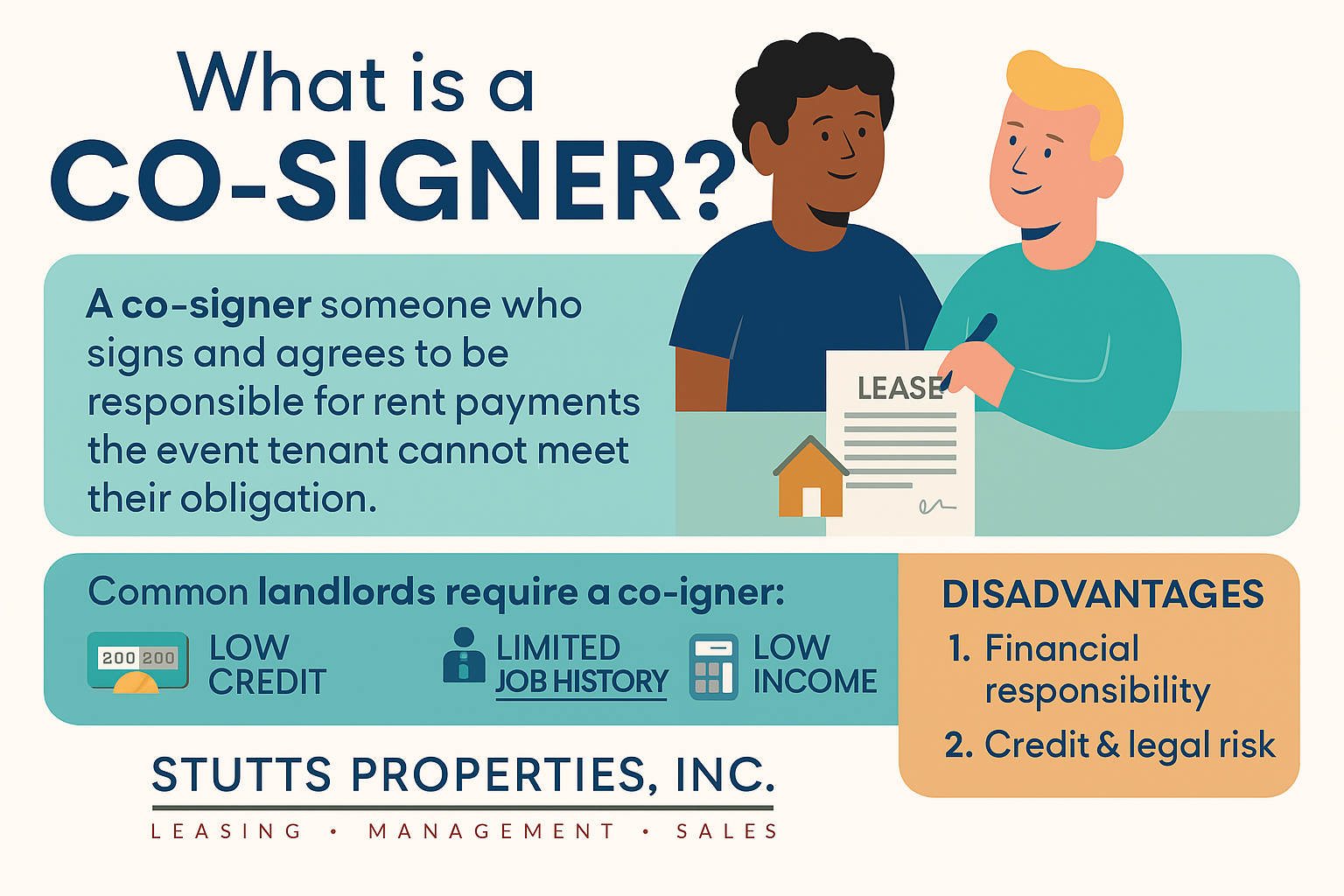

A cosigner is a person who signs a lease, loan, or credit agreement alongside the main applicant, promising to take on full financial responsibility if the main person fails to meet the payment. They act as a financial backup and help the primary applicant qualify when they have poor credit, low income, or no rental history.

Key Points to Note in Cosigner Meaning:

- Shares equal legal obligation for the agreement

- Does not benefit directly from the lease or loan

- Often required by landlords or lenders for high-risk applicants

- Their credit and finances are at risk if the main applicant defaults

Cosinger Definition in Simple Terms

A cosigner is simply defined as someone who agrees to pay if the person they’re helping can’t. They sign a lease or loan with the main person, promising to cover the costs if needed. A cosigner, in a simpler definition, is a backup payer. If you can’t pay rent or a loan, they will.

Cosigner For Apartment?

A cosigner for an Apartment is someone who signs the lease along with the tenant and agrees to share the legal responsibility for the tenant’s rent. They pay for the apartment if the tenant can not pay. You may need a guarantor for an apartment only for specific financial conditions, while a cosigner is more involved in the lease contract.

Essentially, the cosigner becomes a co-tenant in the eyes of the landlord, though they may not live in the rental.

(Read what landlords need to know about rent control laws)

In Simple Words, a Co Signer for Apartment:

A co signer for an apartment is a trusted person who promises to pay your rent if you can’t. Key facts about a co signer for apartment include:

- They are required when the tenant doesn’t meet income or credit requirements

- Must provide proof of income and pass a credit check

- They are equally responsible for the lease payments and legal obligations

- Co signer for apartment are usually a parent, a guardian, or a financially stable relative/friend.

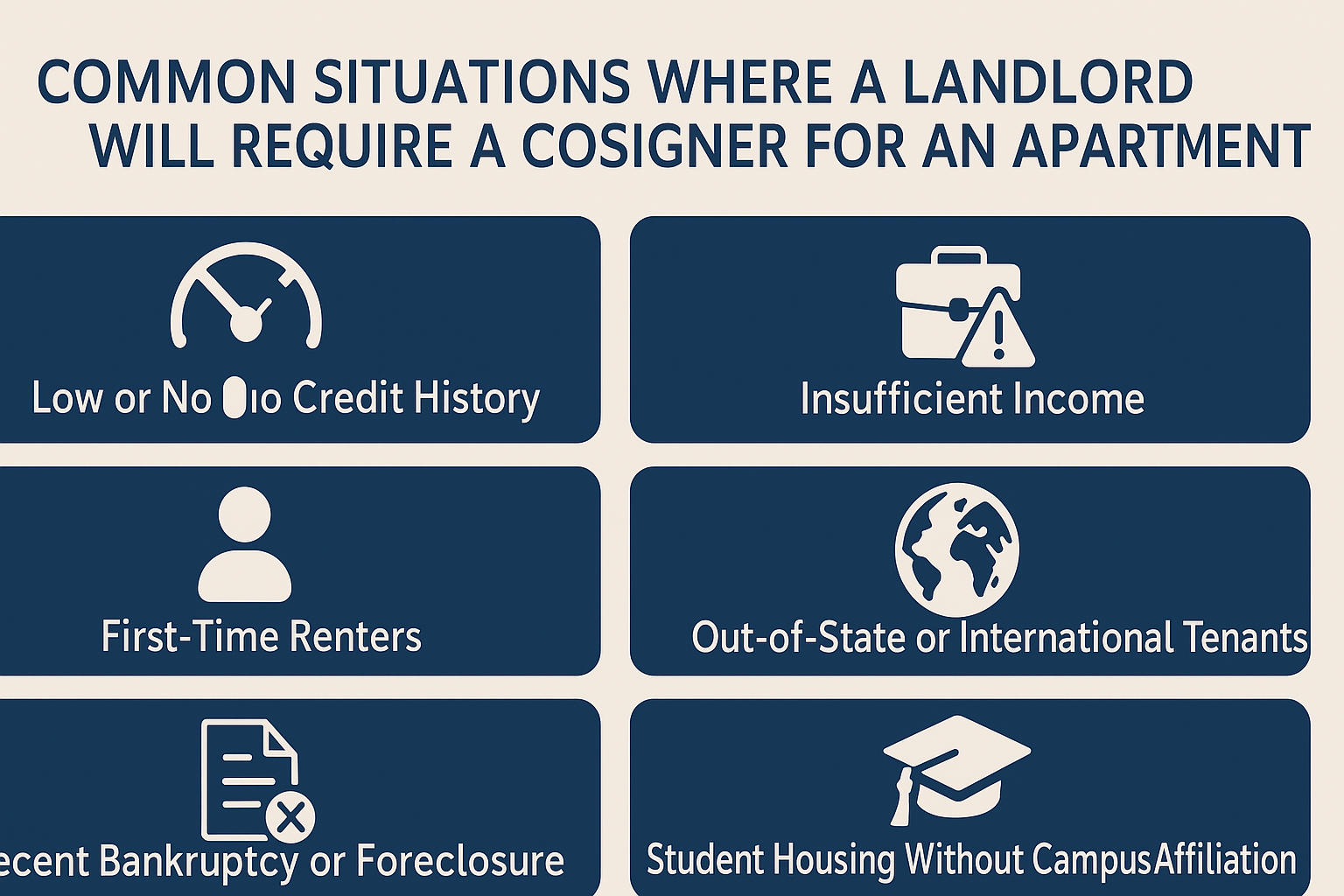

Common Situations Where a Landlord Will Require a Co-signer for an Apartment

Most landlords will require a cosigner for an apartment when they feel the tenant does not satisfy the rent requirements. These are the professional reasons a landlord in Alabama or the US will require a cosigner for an apartment:

Low or No Credit History

If a tenant has a poor credit score or no credit at all, landlords may ask for a cosigner to reduce their risk. This is common with first-time renters and students.

Insufficient Income

Most landlords require that a tenant earn 2.5–3x their monthly rent. If a tenant doesn’t meet this criterion, a cosigner with higher income can be required.

First-Time Renters

Young adults, students, or recent graduates normally have no credit score and no rental history. Renters in this class will need a cosigner for the apartment they want to rent. The cosigner provides financial proof for them.

Job Instability

Another common situation that will require a cosigner for an apartment is if the tenant has job instability. If the applicant just started a job, is self-employed, or has inconsistent income, landlords may seek a cosigner with a steady financial track record.

Recent Bankruptcy or Foreclosure

A recent financial hardship in the tenant’s credit report, such as bankruptcy, will often raise a red flag. In this case, a cosigner is used for assurance.

Out-of-State or International Tenants

If the applicant is new to the area, moving in from abroad, or has no local financial proof, a local cosigner can help reassure the landlord.

Previous Evictions or Late Payments

When a tenant has a history of late rent or eviction, he or she can become ineligible to rent an apartment. The tenant will require a cosigner for the apartment to be considered.

Student Housing Without Campus Affiliation

Private landlords renting to college students often require a cosigner (usually a parent or guardian) because the student may have no income.

Why do landlords require a cosigner for Apartment?

Landlords and house owners require a cosigner for apartment to protect themselves from the financial risk that comes from admitting a tenant who does not qualify on their own. It gives the landlord an extra layer of security.

Cosigner vs Guarantor: What’s the Difference?

The terms cosigner and guarantor are often interchanged, and it is easy to see why. They seem so similar but yet have distinct differences in property management. A cosigner signs the lease alongside the tenant and shares full responsibility for rent and damages from the start. A guarantor, on the other hand, only steps in if the tenant defaults on their obligations.

The cosigner is treated as a tenant by law, even though they may not reside in the rental property.

(Read a guide to future-ready real estate investing)

Cosigner vs Guarantor: Why Both Exist?

- Cosigners give landlords immediate security: “If this person doesn’t pay, I’ll come after you both.”

- Guarantors are more protective of the tenant: “Only if they fail and I’ve exhausted options, then you pay.”

Cosigner vs Guarantor:

| Feature | Cosigner | Guarantor |

|---|---|---|

| Sign the lease? | Yes – they are on the lease | No – they sign a separate agreement |

| Primary liability? | Immediately responsible with the tenant | Only if the tenant defaults |

| Involved in the application? | Yes | Yes |

| Lives on the property? | No (unless co-tenant) | No |

| Appears on credit? | Yes – from the start | Only if required to pay |

| Common use | For co-renters, spouses, etc. | For students, first-time renters |

| Their Promises | Immediately liable | Seconda in Link |

| Nature of Contract | Like a joint renter | Like a safety net |

| Party Preferences | Preferred by most landlords | Preferred by most Tenants |

Cosigner on a Lease: How Does Cosigning Work?

Cosigning works by having a second person, called a cosigner, legally commit to paying rent or covering financial obligations if the primary tenant fails to do so. A cosigner on lease signs the rental agreement alongside the tenant. Both the tenant and the cosigner are legally responsible for fulfilling the terms of the lease.

This means that if rent isn’t paid on time, the landlord can hold the cosigner liable. Having a cosigner on lease is an extra layer of safety. It makes sure that rent is paid even if the tenant struggles financially.

(Read: Can property management companies manage tenant eviction effectively)

Step-by-Step: How Cosigning Works for an Apartment

Tenant Applies for Apartment

The first step is that the tenant will apply for the apartment. The landlord will review their income, credit, and rental history.

Landlord Requires a Cosigner

If the tenant doesn’t meet the qualifications, the landlord will require a cosigner for the tenant. Low income or poor credit is a solid indicator that a tenant needs a cosigner.

Cosigner Applies and Gets Approved

The cosigner must submit documents, including ID, proof of income, and a credit check that proves that he is financially viable.

The Lease Is Signed

The cosigner either signs the main lease or a cosigner agreement as a legal backup. Whatever the case, the cosigner signs the lease.

Tenant Moves In

The tenant pays rent and fulfills the lease. The cosigner is not involved unless a problem arises.

If the Tenant Fails to Pay...

The landlord can legally pursue the cosigner for unpaid rent, damages, or legal fees.

Lease Ends

If no issues arise, the cosigner's obligation ends when the lease is completed or renewed without them.

What are the Roles and Responsibilities of a Cosigner?

A cosigner’s role is to act as a financial backup for the primary tenant. Their main responsibility is to ensure the rent and any lease obligations are fulfilled, even if the tenant fails to do so.

By signing the lease or a cosigner agreement, they become legally and financially accountable for the terms of that lease.

Key Roles of a Cosigner:

Financial Guarantor

A cosigner agrees to cover rent, fees, damages, and legal costs if the tenant can’t or won’t pay.Creditworthy Supporter

Cosigners use their credit profile and income to help the tenant get approved.Silent Partner

Cosigners do not live in the apartment or have the right to occupy the unit.Legal Contract Holder

They are bound by all lease terms and can be sued if the tenant defaults.

Responsibilities of a Cosigner:

| Details | |

|---|---|---|

| Pay Unpaid Rent | If the tenant stops paying, the cosigner must pay the rent in full. | |

| Cover Damages or Fees | Includes property damage, court costs, or lease-breaking penalties | |

| Face Legal Action if Needed | Landlords can sue the cosigner in court for unpaid obligations. | |

| Maintain Good Credit | If rent isn’t paid, their credit score may drop significantly. | |

| Remain Obligated for Lease Term | Cosigners are responsible until the lease ends or is reassigned. |

(read: Understanding the Role of a Guarantor in Property Management)

What is Required to be a Cosigner for an Apartment?

For someone to pass as a cosigner, the person must meet defined financial and legal requirements. Landlords are trusting this person to cover rent or lease demand if the tenant fails, so they want someone stable, creditworthy, and who can be relied upon.

Cosigner Requirements:

Good Credit Score

Typically 680 or higher

Shows a history of on-time payments and low credit risk

Stable Income

Must earn at least 3–5× the monthly rent

W-2, 1099, or tax returns may be required

Proof of Employment

Recent pay stubs or employment letter

If self-employed, recent tax returns or bank statements

Low Debt-to-Income Ratio

Lenders and landlords prefer a DTI below 40%

Shows ability to manage existing debts while backing the lease

Valid Identification

Government-issued ID (driver’s license, passport, etc.)

U.S. Citizenship or Legal Residency

Most landlords require a cosigner to be legally present in the country

Legal Age

Must be 18 years or older to sign a binding contract

Willingness to Sign the Lease or Cosigner Agreement

Cosigners must understand the risks and agree in writing to be held liable

What happens if a co signer for apartment defaults?

If a co signer fails to meet their financial or legal obligations after the tenant defaults, serious consequences can follow for both the tenant and the co signer. A co-signer's role is to guarantee payment, so defaulting means they are legally breaking a contract.

Key Consequences of a Co-Signer Defaulting:

Legal Action by Landlord:

The landlord can sue the co-signer in court for unpaid rent, damages, or lease violations.

Credit Damage:

Defaults are reported to credit bureaus. This will cause the co-signer’s credit score to drop, sometimes by 100+ points.

Debt Collection Agencies:

If payments go unpaid, the debt may be sent to collections, leading to repeated contact, fees, and long-term credit issues.

Court Judgments and Garnishments:

If the landlord wins a judgment, they may garnish wages or place a lien on the co-signer’s assets.

Loss of Financial Standing

The cosigner may struggle to get loans, mortgages, or even rent a place themselves in the future.

Can you get out of a lease after cosigning?

In most cases, the answer is no, you can not just get out of a lease after cosigning. A cosigner is legally bound to the lease terms for the entire duration of the agreement, just like the tenant. A cosigner is legally bound to the lease terms for the entire duration of the agreement, just like the tenant.

Why You Can’t Just Back Out:

When you cosign, you enter a binding legal contract. This means you are on the lease for rent, fees, or damages if the tenant fails to pay. So, until the lease ends or the landlord agrees to release you, you can not get out of a lease after cosigning.

If you plan to cosign, ask about the release process up front before signing. Understand the process to get out of the lease and request a written policy.

Steps of getting out of a lease after cosigning

| Option | Description |

|---|---|

| Lease Termination | If the tenant and landlord agree to end the lease early, your obligation ends too. |

| Lease Transfer or Sublet | If the tenant assigns the lease to someone else (and the landlord agrees), you may be released. |

| Requalification Without You | If the tenant’s credit/income improves, they can request to reapply without needing you. |

| Request a Release | Some landlords may allow a cosigner release form, but they are not required to. |

| Wait for Lease Expiry | Once the lease term ends and there are no outstanding debts, your role ends automatically. |

The Benefits and Disadvantages of Being a Cosigner

Becoming a cosigner can be a lot, so it’s important to understand the risks and rewards. Here are some of the pros and cons of being a cosigner.

Benefits of Being a Co-Signer:

- Helping a Loved One: You assist someone in securing a rental they may not qualify for alone.

- Limited Commitment: You only need to cover rent if the tenant defaults.

- Support Their Independence: It allows students and young adults to secure stable housing

- No Upfront Cost: You are not required to make any payment until the tenant defaults, unless you intend to take the responsibility.

- Build Trust and Relationship: It is an opportunity to build trust with someone you love and show support

Disadvantages of Being a Cosigner:

- Financial Liability: If the tenant misses payments, you are responsible for rent and damages.

- Credit Impact: Unpaid rent can affect your credit score, leading to long-term financial impacts.

- Legal Obligations: You are bound to the lease by law. This makes it difficult to remove yourself from the agreement.

- Strained Relationship: If issues arise, it can create tension or harm your relationship with the tenant

(Read Do my property management fees cover rental maintenance)

Conclusion: Is a Cosigner the Right Choice?

For tenants, having a cosigner can make it easier to secure housing, especially when financial qualifications fall short. For landlords, a co-signer on a lease offers protection against financial risk. Understanding the responsibilities of being a cosigner or requiring one is crucial for both parties.

Before agreeing to co-sign, ensure that both you and the tenant understand the legal and financial obligations. When you cosign, your financial well-being is tied to the tenant’s ability to meet the lease terms. So, be sure to fully evaluate the risks before making this commitment.

(What is Sublease? How does a sublease work?)

(Read tenant portal steeemline)

Frequently Asked Questions (FAQs) on Cosigner

Can you have a cosigner on a rental?

Yes, you can have a cosigner on a rental. Many landlords allow tenants to have a cosigner on a rental lease. A cosigner is someone who agrees to pay the rent if the tenant fails to meet the lease term.

Why don't landlords like cosigners?

It’s not always true that landlords don’t like cosigners. A cosigner doesn't guarantee timely payments, and enforcing financial responsibility can be challenging. So, most landlords prefer to get a tenant who can pay the bills instead of the trouble of having a cosigner.

(Read the essential guide to rental analysis)

How long does a co-signer stay on a lease?

How long a co-signer stays on a lease is dependent mostly on the duration of the lease. A co-signer remains on the lease for the entire lease duration unless the landlord agrees to remove them.

Why Would You Need a Co-signer?

Many landlords require a co-signer when a tenant doesn't meet financial standards. For example, if a tenant has:

- A low credit score

- An inconsistent income

- No rental history

In these cases, a co-signer provides the landlord with added security. The co-signer is responsible for paying rent and covering other costs if the tenant defaults.

Read about understanding property management fees

Can Anyone Be a Co-signer?

Most often, co-signers are family members or close friends. To qualify as a co-signer, a person typically needs:

- Good credit

- A stable income

- Willingness to accept legal responsibility for the lease

Some property management companies may even allow businesses to serve as co-signers.

(Read about adapting to work from home)

How to Add a Co-Signer to Your Lease

To add a cosigner to your lease, you will need to fill out a separate agreement or sign as a joint tenant. Property management companies usually perform a background check on the co-signer to ensure they are financially reliable. If they qualify, the co-signer is added to the lease, and both parties will share the legal commitments.

(Read 4 key steps to effective tenant placement for North Alabama)

When Should You Get a Cosigner?

Some conditions as a tenant will require a cosigner on your lease. Some of such conditions include;

- a low credit score,

- limited rental history, or

- An unstable income.

A cosigner can make it easier to secure a rental. The co-signer provides the landlord with peace of mind, knowing there’s someone else responsible if you can't pay rent.

(Read top strategies for preventing late rent payments)

Can a Cosigner Be Removed From the Lease?

Once a cosigner signs a lease, it’s not easy to remove them. In most cases, both the tenant and the landlord must agree to remove the cosigner. The tenant must also prove financial stability. They will need to show that they can meet the rental obligations on their own.

Some leases may allow for a cosigner to be removed after a set period. This can be when the tenant’s credit score or financial situation improves.

How do I protect myself as a cosigner on an apartment?

To protect yourself as a cosigner on an apartment, first review the lease terms carefully. You must make sure the tenant is financially responsible.

- Request regular updates on rent payments

- Set a limit on your liability if possible

- Consider a written agreement with the tenant.

- Also, ask the landlord about release options if the tenant builds a solid payment history.

How does a co-signer work on a lease?

How a co-signer works on a lease is straightforward. A co-signer agrees to take financial responsibility if the tenant fails to pay rent or violates the lease. They sign the lease but don’t live in the rental, serving as a financial backup to reassure landlords.

Does cosigning hurt your credit?

Cosigning can hurt your credit only if the tenant misses payments or defaults on the lease. Since you are responsible for the debt, it may affect your credit score if the landlord reports non-payment to credit bureaus.

Do most apartments accept Co-signers?

Many apartments accept co-signers, especially if the tenant has poor credit, low income, or no rental history. However, the acceptance depends on the landlord’s policies and the co-signer’s financial strength.

How much does it cost to hire a cosigner?

The cost of hiring a cosigner varies and is negotiable. Some cosigners may charge a one-time fee or request a percentage of the monthly rent. There’s no standard cost, so it’s important to discuss terms upfront with the cosigner.

What happens to the cosigner if I don't pay rent?

If you don’t pay rent, the cosigner becomes financially responsible for the missed payments. The landlord can contact the cosigner for payment, and any overdue rent can affect their credit score as well.

Can I remove a cosigner from my lease?

Yes, you can remove a cosigner from your lease, but it requires the landlord’s approval. You must typically prove financial stability. You must have a steady income or improved credit before the landlord will consider releasing the cosigner.

Can someone cosign a lease and not live there?

Yes, a cosigner does not need to live in the rental property. Their role is to convince the landlord that rent will be paid if the tenant defaults. But they are not required to reside in the unit.

Can a landlord refuse a cosigner?

Yes, a landlord can refuse a cosigner if they don’t meet the financial criteria. A cosigner can also be refused if the landlord has specific policies against cosigners. The cosigner must typically have a strong credit history and stable income for approval.

Can I still get denied with a cosigner?

Yes, you can still be denied even with a cosigner. If the cosigner has poor credit, or insufficient income, or the landlord has other concerns, they may reject the application.

Does a cosigner's income count?

Yes, a cosigner's income is often considered by landlords when determining whether to approve a rental application. The cosigner’s financial stability provides assurance that rent will be paid if the tenant defaults.

(Read 5 key strategies for North Alabama accidental landlords to succeed)

Can I remove myself as a cosigner?

Removing yourself as a cosigner is possible, but it typically requires the landlord's approval. You may need to prove that the tenant can meet the lease obligations on their own, such as showing improved credit or financial stability.

What fees do you pay as a cosigner?

As a cosigner, you generally do not pay any fees upfront unless specified in the lease agreement. However, if the tenant fails to pay rent or damages the property, you may be responsible for those costs.

What credit score does a cosigner need for an apartment?

The required credit score for a cosigner varies by landlord and property management company. Typically, a cosigner should have a credit score of at least 650 to 700 to be considered a strong candidate. However, some landlords may accept a lower score if the cosigner has a stable income or other financial factors.

(Read insurance claims for rental property)

Do landlords like cosigners?

Landlords may appreciate cosigners as they provide an added layer of financial security. Cosigners help ensure rent is paid on time, especially if the tenant has a low credit score or unstable income.

How do I protect myself as a cosigner?

You can protect yourself as a consigner by ensuring you fully understand the lease terms and your financial obligations. Keep communication open with the tenant about rent payments, and request regular updates.

What rights does a cosigner on a lease have?

A cosigner does not have the right to live in the rental property or make decisions regarding the lease. Their primary role is to take financial responsibility if the tenant fails to pay rent or damages the property.

(Read how to handle late rental payment)

How do I remove a cosigner from my rent?

You can remove a cosigner from your rent by requesting the landlord’s approval. But only if you meet the lease obligations on your own, such as providing proof of stable income or improved credit. The landlords may allow a cosigner to be removed from your rent after a positive payment history is established.

What proof of income do you need for a cosigner?

As a cosigner, you need to provide proof of income, such as pay stubs, tax returns, bank statements, or a letter from your employer. This ensures they can cover the rent if the tenant defaults.

Do first-time renters need a cosigner?

First-time renters may need a cosigner if they lack a rental history, have poor credit, or do not meet income requirements. A cosigner can help guarantee the lease and provide the landlord with added security.

(Read how to maximize rental income)

Can a cosigner go to Jail?

No, but they are legally responsible for paying any overdue rent or damages if the tenant defaults. But legal action can be taken against them if they fail to pay.

Do FHA loans allow co-signers?

Yes, FHA loans help borrowers who may not meet income or credit score requirements.

How do I protect myself as a cosigner?

To protect yourself as a cosigner, ensure that you fully understand the terms of the lease. Make sure to keep an open communication with the tenant. You can also request to be released from the lease after a certain period, if possible.

(Read how rental valuation impacts your investment success)

Can a Co-Signer Help You Get Better Lease Terms?

In many cases, having a co-signer can lead to more favorable lease terms. Landlords may lower the security deposit if they know there’s a reliable co-signer on the lease. They can also offer flexible lease lengths or reduce rental fees.

What Happens if a Co-Signer Defaults?

If a co-signer fails to meet their obligations, the property owner can take legal action. This could include garnishing wages, seizing assets, or reporting the debt to credit bureaus. Failing to fulfill the co-signing responsibilities can significantly damage the co-signer’s financial standing and credit score.

(Read The Fair Housing Act)

How a Cosigner Protects the Landlord

For landlords, having a cosigner on lease reduces the risk of non-payment. If the tenant misses rent, the cosigner is required by law to cover the debt. This ensures that landlords won’t lose out on rent, even if the tenant faces financial difficulties.

(Read the ultimate guide to eviction protection for North Alabama rentals)

Do Tenants Always Need a Cosigner?

Not every tenant requires a co-signer. Landlords usually ask for one only when the tenant doesn’t meet the financial criteria for the rental. If you have good credit, a stable income, and a solid rental history, a cosigner may not be necessary.

The Risks of Being a Cosigner

Agreeing to be a co-signer is a serious decision. Before you commit, it’s important to weigh the risks. You’ll be legally responsible for the rent if the tenant cannot pay. This could impact your financial situation.

Consider your relationship with the tenant and whether you trust them. You must be able to trust them to fulfill their obligations before signing a lease as a cosigner.