A credit score is a number that shows how good you are at handling money. Many places, like banks, landlords, and even some jobs, look at your credit score. If your score is high, people trust you more and this is why you need to know how to increase your credit score. Getting loans, good interest rates, or even renting a home can be hard if it's low.

In Florence and the US, many people look at your credit score and conclude whether you can pay your bills. Hence, it is vital to have a good score. Let us look at the ways you can improve it.

(Read what landlords need to know about rent control laws)

What is a Credit Score?

Your credit score is a number that shows how well you manage your money. It is based on your credit history, such as whether you pay bills on time and how much debt you have. Scores range from 300 to 850, with 300 being low and 850 high. In summary, your credit score is a rating that shows how fast you pay your bills and how much debt you owe.

Credit scores come from three main companies in the U.S.:

- Experian

- Equifax

- TransUnion.

Each company might have a different score for you, but they are usually close.

(Read understanding property management fees)

What is a Good Credit Score?

Understanding average scores in the U.S. and what score range is good enough can be useful. Generally, a good credit score ranges from 670 to 739 on the commonly used FICO scale (300 to 850). Let us give you a breakdown of the FICO score ranges and what they typically mean:

- Excellent Credit Score (800-850): This range indicates exceptional creditworthiness. It qualifies you for the best interest rates and terms.

- Very Good (740-799): People in this range usually receive favorable terms and low interest rates.

- Good (670-739): This is considered a solid credit range; most lenders view people in this range as reliable borrowers.

- Fair (580-669): This range is below average, and borrowers may face higher interest rates or more limited options.

- Poor (300-579): Borrowers in this range often have difficulty securing credit. They may be offered the highest rates.

The FICO score is the most widely used. However, some lenders use the VantageScore model, which has slightly different ranges but generally aligns.

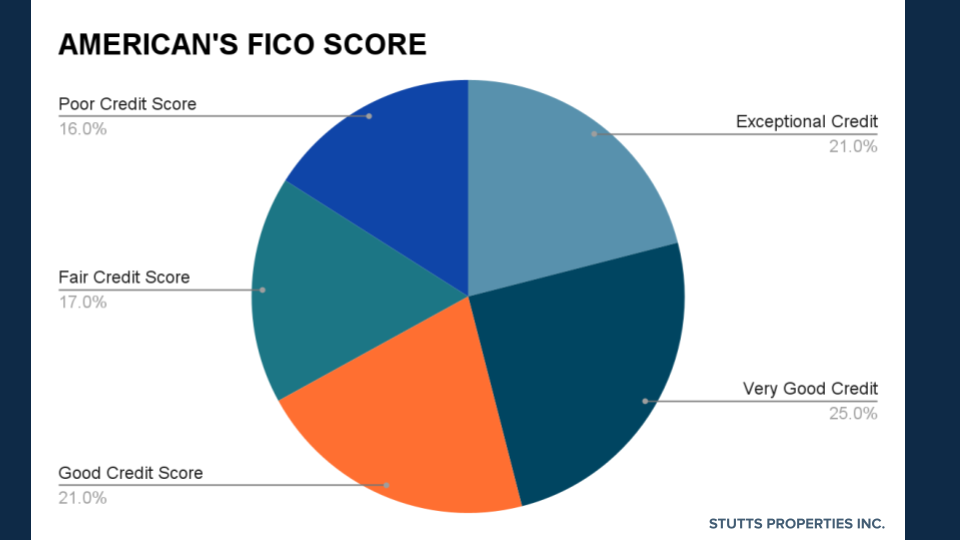

According to Experian data, 16% of people in the US have a poor credit score of below 580. The following breakdown was given:

- Excellent Score is 800-850 (21% of people have this range)

- Very Good Score is 740-799 (25% of people have this range)

- Good Score is 670-739 (21% of people have this range)

- Fair Score: 580-669 (17% of people have this range)

- Poor Score: Below 580 (16% of people have this range)

Why is a good credit score important?

A lot of benefits come with a good or high credit score. A high credit score makes life easier for Alabama and the United States residents. With a good score, you can be able to do the following:

- Get Loans Easily: Banks are likelier to lend to people with good credit. This is because they are sure you will pay back since you have a good score. Your credit score is like a guarantor that tells them you can be relied on.

- Better Interest Rates: A high score means you pay less interest on loans. Since you have a good credit score, you pose less risk of default. Since you pose less risk, your interest will be less.

- Better Job Chances: Some jobs check credit scores. Most employers want to employ someone with financial integrity. This criterion is more serious for finance-related job roles and companies that deal with money. A high score can help.

- Lower Insurance Costs: Many insurance companies offer lower rates to people with high scores. Like banks, most insurance companies will trust a person with a good credit score. And because they trust you, you represent a good deal.

- Better Chance at Renting a House: Most landlords in Florence, Alabama, and the Shoals area check for credit scores before giving their rentals out. This is also common practice all over Alabama and the US. They use the score as a guide to prove if you can renew your rent. A good credit score will help you get a good rental.

(Read can property management company handles tenant eviction)

What is a credit score used for?

You can use a good credit score for many things and make your life easier. Credit scores help lenders decide if they should lend you money. Here are some things that use your credit score:

- Mortgage: You can easily get a good mortgage with a good credit score. A good score increases your chance of getting a mortgage.

- Car Loan: You can also get a car loan on the trust of your credit score. The higher your score, the better your chance and the lesser your interest.

- Bank Loans: You can easily get a loan with a good score rating. It makes it easier for the bank to consider you for a loan.

- Academic Loan: With a good credit score, getting an academic loan is much easier. Your score will increase your trust level.

- Renting an Apartment: Many landlords check scores before renting. You use your good score to get a good apartment of your choice.

- Setting Up Utilities: Some companies check credit before installing electricity or internet. You can easily get some utilities with a good score.

- Credit Cards: High scores help you get cards with better rewards.

(Read adapting a work from home trends designing rentals for remote professionals)

What is an Acceptable Credit Score?

A good credit score is not necessarily the same as an acceptable one. A satisfactory credit score will depend on what you intend to use it for. Credit score requirements can vary significantly across different areas. They vary for renting an apartment, getting a job, securing a car loan, or qualifying for insurance.

Below is a breakdown of typical credit score expectations in each of these situations:

1. Credit Score for Apartment Rental

A typical credit score for apartment rentals in Alabama and the US is 620 or higher. However, some landlords may be willing to go lower. Students' properties, for example, prefer a minimum of 600 and it's still considered high for some people.

Landlords often look for a minimum score of around 620 to feel confident a tenant can make consistent rent payments. However, luxury apartments or competitive markets may require higher scores (e.g., 700+). While more lenient landlords may accept scores around 580-600, especially if you have a good rental history or a co-signer.

(Also read The Role of a Cosigner.)

2. Credit Score For Jobs

Most employers don’t require a minimum credit score. However certain positions, especially in finance, government, or management, may check credit reports as part of a background check. They don't look at the score itself; they may just examine specific details. Some of the details they look at are debt levels, bankruptcies, or a history of missed payments.

Employers typically focus on signs of financial stability, especially for roles that involve money or sensitive information. So, there is no specific acceptable credit score for jobs.

(Read key steps to effective tenant placement in north Alabama)

3. Acceptable Credit Score for Car Loans

The acceptable credit score for car loans is typically 600 and above for standard rates, with the best rates at 700+. For a car loan, lenders generally require at least a fair score (around 600-660).

Scores over 700 can qualify you for lower interest rates. While scores in the 500s may still be eligible, but at a high interest rate. Some lenders even offer special financing for scores below 600, but these come with higher costs and stricter terms.

4. Acceptable Credit Score for Insurance (Car, Home, Life)

600 is often ideal as an acceptable credit score for insurance, but it varies by state. In most states, like Alabama, insurance companies use a variation of your credit score (called an insurance score). It's used to set premiums.

Generally, a score over 600 can help you get a lower premium. At the same time, lower scores may result in higher premiums. However, not all states allow credit-based insurance scoring. This is more heavily used in car and home insurance than life insurance.

(Read guide to future ready real estate investing)

%20Technology%20Project%20Proposal%20Infographics%20by%20Slidesgo%20(1).png)

Disadvantages of a Low Credit Score

A low credit score can create a lot of issues. Here are some of the common issues:

- Higher Interest Rates: Banks may insist on high rates with a low score because your score implies that you can't be trusted.

- Harder to Get Loans: Banks may not lend you money at all. A low score does not show the chance of paying back.

- Missed Job Opportunities: Some jobs won’t hire people with low scores. Employers are worried that such a person may come under pressure, which can lead to office fraud.

- Higher Insurance Rates: Low scores can increase your insurance cost.

- Difficulty in Renting an Apartment: Most landlords won't give their house to someone with a low credit score. They fear that such a person may not be able to renew the rent.

(Read strategies for preventing late rent payment)

Things That Lower Your Credit Score

Many things can lead to low scores. Some people fall into debt because of medical bills, job loss, or other hardships. Others may not know how to manage credit yet. Education on credit scores is key to improving them.

Nevertheless, we have listed a few things that affect and lower your credit score. You should do your best to avoid them.

- Late Payments: When you pay your bills late, it hurts your score. Always try to pay your bills on time.

- Maxing Out Credit Cards: Using too much credit is bad. Avoid impulse buying and keep balances low.

- Having a Lot of Debt: Owing a lot of money can lower your score.

- Too Many Credit Applications: Applying for credit too often can hurt your score.

- Ignoring Old Debt: Old unpaid bills can still lower your score.

(Read do property management fees cover rental maintenance)

How to Increase Your Credit Score

You can raise your credit score by taking some of the steps outlined below. You don't need to cheat, but with this hard work, your score can go up faster. Let’s go through some of the steps you can take to increase your credit score.

1. Review Your Credit Report for Errors

Start by getting a copy of your credit report. Get it from the major credit bureaus (Equifax, Experian, and TransUnion) at AnnualCreditReport.com. Review it for errors, such as incorrect account details or payments marked as late that you made on time. Also, check for accounts that don’t belong to you and argue and correct any errors directly with the credit bureaus.

2. Pay Bills on Time

One of the biggest factors in a credit score is payment history. Your payment history makes up about 35% of your credit score, so paying bills on time is essential. Set up automatic payments or reminders to avoid missing due dates.

A single late payment can lower your score, so consistency is key. If you pay bills late, your score goes down. Set reminders or use auto-pay to stay on track.

(Read ultimate guide to eviction protection for north alabama)

3. Keep Balances Low on Credit Cards

Your score will go down if you use too much of your credit limit. This is called the credit utilization ratio. Try to keep it below 30%, and ideally lower than 10%. If you have a $1,000 limit, keep the balance under $300.

4. Pay Down Debt Strategically

Consider using strategies like the “snowball” method, where you pay off small debts first to motivate yourself. You can also use the “avalanche” method to tackle high-interest debt first to save on interest costs. Reducing total debt improves your credit utilization and makes managing payments easier.

5. Become an Authorized User on Another Person’s Account

Share an account with a trusted family member or friend with a strong credit history. When you become an authorized user of their account, it can help improve your credit. You don’t need the card; being associated with a positive account can help boost your score.

(Read essential guide for rental analysis in north Alabama)

6. Don’t Close Old Credit Cards

Keeping old accounts open can help your score. When you close a card, your credit history shortens, which can lower your score. The age of your credit accounts impacts your score, so keeping older accounts open is generally beneficial.

If you have an old credit card you rarely use, keep it open even with a zero balance. It can improve your score by increasing your average account age and available credit.

7. Pay More Than the Minimum

If you only pay the minimum, lowering your debt can take longer. When you pay extra, it shows that you are responsible with money and can raise your score.

8. Get a Secured Credit Card

If your score is low, a secured credit card can help. This card type requires a cash deposit, which becomes your credit limit. Using it and paying it off can build your credit.

9. Use Credit Mix Wisely

Credit score companies like to see a mix of credit types. If you have a credit card and a loan, it may help your score. But don’t open new accounts just for this purpose.

(Read the fair housing act)

10. Avoid Applying for Too Much Credit at Once

Each time you apply for credit, it shows as a hard inquiry on your report. Too many inquiries can lower your score. Only apply for new credit when you need it.

11. Limit New Credit Applications

Applying for new credit too frequently can hurt your score. Each application causes a “hard inquiry” on your report, which can slightly lower your score. Only apply for credit when necessary, and try to space out applications.

12. Ask for a Credit Limit Increase

You can ask for a limit increase if you have a credit card and use it well. This lowers your credit utilization rate and can help your score. But make sure not to use the extra limit to build more debt.

13. Consider a Credit-Builder Loan

Some banks and credit unions offer “credit-builder loans” designed to help people improve their credit. With these loans, you make payments over time. Once fully paid, you receive the loan amount, which builds your credit history.

14. Consider Credit Counseling

If you are struggling, a credit counselor can help you make a plan to raise your score. They will analyze your credit position and help you plan a way out. It may also include budget control and financial aid.

15. Monitor Your Progress

Many financial institutions and apps offer free credit score monitoring. This can help you track improvements and understand how specific actions impact your score. Monitoring also helps you spot potential issues early on.

(Read understanding tenant credit report)

How to Track Your Progress

To stay on top of your score, you need to check it often. Many services let you view your credit report for free. Here are three ways to track your credit score:

AnnualCreditReport.com: You can get one free report from each credit bureau every year. This report can help you track your progress. You can strategically get reports from each bureau at different thirds of the year.

The reports from each bureau are not the same, but the reports are close. This way, you can get an idea of your progress report every four months.

Credit Card Services: Some credit cards offer free score tracking. You can easily request a report from your credit card service if they offer tracking options.

Apps and Websites: Websites like Credit Karma offer free score updates. You can identify some reliable ones and try them out. Do proper research and ensure they can be trusted before you move forward with them.

Conclusion

Improving your credit score takes time and effort, but the results are worth it. With a better score, you’ll have more financial options and can save money on interest. Start with small steps, like paying on time and lowering credit card balances. Each step will help you reach your goal of a higher score.

Important Note: The information in these posts does not substitute for legal, professional, or financial advice. We recommend you verify any details with your consultant or contact our team of professionals at Stutts Properties, INC.