What is a Rent Roll?

A rent roll is an important document used by property managers, investors, and landlords to track rental income. It serves as a financial document that provides an overview of tenants, lease terms, rental amounts, and payment history. Property owners use rent rolls for efficient and organized rental operations. Rent roll document helps in managing multiple rental units and ensuring consistent rental income.

What is a Rent Roll Use For?

The rent roll report summarizes the financial performance of rental properties by listing key details for each tenant. These details typically include the tenant’s name, rent amount, lease start and end dates, and payment status. Property managers rely on this document to make informed decisions about property maintenance and leasing strategies. Additionally, it assists landlords in managing their cash flow and tracking overdue payments.

A rent roll can also serve as a clear overview in evaluating a property's financial health for investors. It provides a snapshot of the rental income over a specific period. This offers insights into occupancy rates and rent collection. You can also read about the capitalization rate

Summary: What is a Rent Roll?

Rent roll is a document or sheet that indicates a property’s potential for generating a profit. This document remains important for efficient property management and financial planning. They are also essential during property sales or when applying for a loan.

How to become a successful real estate investor

Who Needs/Uses Rent Roll?

Rent roll is used by a variety of stakeholders, including landlords, property managers, investors, and lenders. Government agencies also benefit from using a rent roll. Below is a summary of how these stakeholders use the rent roll:

- Landlords: For landlords, it provides a way to track rental income and tenant information. Property managers rely on rent rolls to manage multiple units and monitor cash flow.

- Real Estate Brokers: Real estate brokers in Florence may also utilize rent rolls to assist in the sale of properties. They help showcase a property’s rental income potential, making the property more attractive to buyers.

- Lenders: Lenders, too, often require a rent roll when evaluating loan applications for rental properties. The rent roll provides lenders with a clear picture of the property’s cash flow and profitability.

- Real Estate Investors: Real Estate investors use the rent roll to determine the profitability of a property and how much they can make from the property immediately.

- Public agencies may request rent rolls for tax purposes, particularly when auditing a rental property. Rent rolls help ensure that all rental income is properly reported.

This document is vital for anyone involved in the management, sale, or acquisition of rental properties in Florence. Therefore, the rent roll is a versatile and widely used tool in the real estate industry.

Why should you consider investing in Florence, Alabama

How Does Rent Roll Work?

A rent roll works by providing important financial details, an organized overview of rental income, and tenant details. Each entry on the rent roll represents a tenant, including their rental payment, lease duration, and any outstanding balances. This document allows landlords to track when payments are due, which tenants are behind, and when leases are set to expire.

The rent roll needs to be updated regularly to reflect changes in rent amounts, new leases, or tenant move-outs. Landlords and property managers can use it to project future rental income. They can also use it to assess the financial health of the property.

Additionally, it provides an overview of vacancy rates and occupancy trends. The rent roll helps identify units that need to be filled and allows for better financial planning.

For buyers, the rent roll is essential in evaluating the cash flow of a rental property. They can assess current rent rates, determine potential rental increases, and forecast profitability. As such, the rent roll is an indispensable document for managing and evaluating rental properties. In Florence, property owners use rent rolls to stay organized and ensure their properties remain profitable.

(Read: RENT RECOVERY SOLUTIONS)

%20(16).png)

Benefits of Rent Roll Document

Rental Roll Benefits for property managers and landlords are vast. It provides a streamlined way to track down gross rental income and tenant information. Some of the benefits of a rent roll document include;

Forecast Cash Flow

One of the key benefits of a rent roll report is the ability to forecast cash flow. By having all tenant and lease information in one document, property owners can project income over time.

Identify Potential Issues in Early

A rent roll also helps property managers and landlords identify potential issues early. For example, if a tenant falls behind on rent payments, the document highlights this. This will enable the manager to take action.

Simplifies the Lease Renewal Process

Furthermore, a rent roll simplifies the lease renewal process. It alerts property owners to upcoming lease expirations, allowing them to plan for renewals or new tenants in advance.

Maximize Your Market Rent

An increase in a competitive rental market helps investors evaluate the return on investment (ROI). It also helps to identify opportunities for increasing market rent or improving occupancy rates. The document provides a clear comparison of current rents against market rates, helping landlords adjust accordingly.

The manager in charge of monitoring the property also benefits from the rent by accessing financial data. This helps ensure that properties continue to generate steady income throughout the year. These benefits make rent rolls indispensable for property owners.

Property Value Estimation

Rent roll is a guide to the buyer to check whether the property is a good deal. It can be used to estimate the value of a rental property. With rent roll, the buyer can assess how much income the property is bringing in and whether it aligns with their financial budgets.

Tax Estimation

Government workers use the Rent Roll to access the property owner's tax liabilities. The document must contain detailed records of all rental income, which is important for accurate tax reporting and helps tax authorities determine whether property owners are paying the right amount of tax.

Loan

Lenders use this document to assess the financial stability of both the borrower and the rental property. They get a detailed overview of the property’s income, which helps them determine whether the property owner qualifies for a loan.

(Read on Foreclosure)

Processes in Creating a Rent Roll

We set up a comprehensive process for creating a rent roll for your rental property. Start by gathering the necessary information, which includes;

Property Owner Details:

The owner of property details, including the name of the owner, their contact information, and any co-owners or managing agents involved. This section clarifies who is responsible for the property's management and income collection.

Vital Information of the Property:

Get or secure detailed information about the property. This includes the number of units, unit types (e.g., residential, commercial), and physical addresses. This information helps property managers categorize and organize the different rental units within a Property.

Rental Income:

For each tenant, list their name, the unit they occupy, and the rent they pay. Begin by creating headings that will organize your rent roll. Common headings include "Tenant Name," "Unit Number," "Monthly Rent," "Lease Start Date," "Lease End Date," and "Payment Status.

Rental Unit:

Gather details for each of your rental units. This includes its size, type (e.g., studio, 2-bedroom apartment), and rental rate. This section helps to compare the performance of different units and analyze rental trends across a property.

Summary:

This part summarizes the total rent collected for each unit. It also takes into account the total rent for the entire property. This provides a clear picture of the property’s overall rental income, which is crucial for financial planning.

(Read: RENT INCREASE NOTICE)

How to Fill Out a Rent Roll

Filling out a rent roll ensures you enter accurate details and accurate data entry. It begins by listing the property name, followed by individual tenant details. For each tenant, include their name, unit number, rental rate, and payment status.

Be sure to update this document regularly to reflect any changes. Such as rent increases, lease renewals, lease agreements, or tenant move-outs.

Property managers often use property management software to automate the process of filling out rent rolls. This software generates a rent roll based on tenant information entered into the system. This makes it easier to keep the document up to date.

Essentially, review the rent roll regularly to ensure its accuracy. This will also help to identify any discrepancies or overdue payments.

Whether using software or a manual method, the key is consistency and accuracy. Regularly updating the document ensures financial transparency

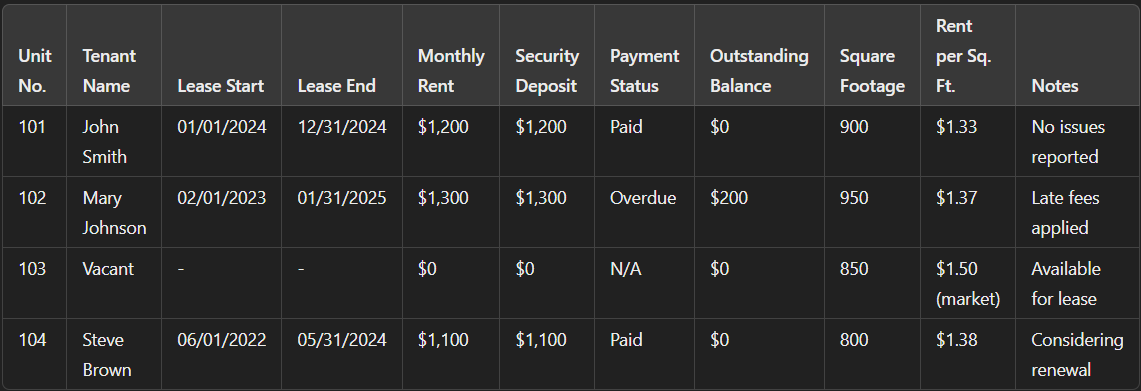

Free Rent Roll Template

Above is a free rent roll template you can adapt for your property.

- Unit No. Identifies the unit and (e.g., apartment number, office suite).

- Tenant Name: Name of the tenant on the lease of the unit. Use "Vacant" for empty units.

- Lease Start/End: Dates the lease begins and ends.

- Monthly Rent: The agreed monthly rent for the unit.

- Security Deposit: The deposit amount held for the tenant.

- Payment Status: Notes if rent is Paid, Overdue, or Partially Paid.

- Outstanding Balance: Any unpaid rent or charges due from the tenant.

- Square Footage: The size of the unit is especially useful for commercial properties.

- Rent per Sq. Ft.: Calculated by dividing monthly rent by square footage. Relevant for commercial properties.

- Notes: Space for additional information (e.g., maintenance issues, renewal interest).

Examples of Rent Roll

This is a simple rent roll example in Florence

"Dee Joe, Unit 2A, $1,300/month,

Lease Start: 01/01/2023,

Lease End: 12/31/2023,

Payment: Current."

This approach shows essential information about tenants, including their payment status and lease dates. A well-structured rent roll provides a clear financial snapshot of rental properties.

In Florence, rent rolls may vary depending on the type of property. For example, commercial rent rolls might include additional details, such as shared expenses or percentage rent. For a mixed-use property, the rent roll could include both residential and commercial tenants. Each type of rent roll is tailored to the specific needs of the property owner.

For large apartment complexes, a rent roll might contain hundreds of entries. Each unit would have its row, listing tenant details and rental rates. Such examples show the importance of staying organized to avoid financial confusion. Reviewing different examples of rent rolls can provide useful templates for creating your own.

Also read;

Property management tips in Alabama

Effective ways to attract tenants

Everything about inventory homes and customized homes

Maximum coverage flood insurance for an apartment building

Steps to Manage a Rent Roll Efficiently

1. Organize Property & Tenant Information

Each entry in your rent roll should include:

- Tenant Name – Who is renting the unit?

- Property Address & Unit Number – The location of the rental property.

- Lease Start & End Date – The duration of the lease agreement.

- Monthly Rent Amount – The agreed-upon rent per month.

- Deposit Paid & Due Amounts – Security deposit details.

- Payment Frequency & Method – Monthly, quarterly, or yearly payments and how they pay (bank transfer, check, etc.).

Best Practice: Use property management software (e.g., Buildium, AppFolio, Rent Manager) to store and update rent roll data automatically.

2. Track Rent Payments & Due Dates

- Monitor and update rental payments to avoid late payments and rent collection issues.

- Set payment reminders for tenants before the due date.

- Record paid and outstanding balances in the rent roll.

- Note late fees for overdue rent.

3. Monitor Lease Expirations & Renewals

- Set alerts for leases expiring within 60-90 days.

- Contact tenants early for renewals or move-out plans.

- Adjust rent based on market conditions and lease agreements.

Best Practice: Create a lease expiration calendar and schedule renewal discussions in advance.

4. Record Maintenance & Expenses

- Track property repairs, maintenance costs, and service schedules.

- Allocate expenses against rental income for financial tracking.

- Maintain records of contractor invoices and work orders.

Best Practice: Link rent roll data with financial reports to assess profit and loss.

5. Generate Reports & Analyze Performance

- Review the total rental income vs. expected income.

- Identify delinquent tenants or payment gaps.

- Check vacancy rates and property profitability.

Best Practice: Use reports to make data-driven decisions for improving rent collection and occupancy rates.

Tools for Managing a Rent Roll Efficiently

- Spreadsheets (Excel or Google Sheets) – Ideal for small property portfolios.

- Property Management Software (Buildium, AppFolio, Rent Manager) – Best for automated tracking.

- Accounting Software (QuickBooks, Xero) – Useful for linking rental income with financial reports.

To effectively manage a rent roll, you will need to keep it organized, automated, and up-to-date. The best practice is to use property management software that integrates rent tracking, lease management, and financial reporting.

(Read the Florence rental market)

Conclusion

Rent roll serves as an important tool for property management. It provides the financial transparency needed to track income, manage leases, and plan for future profitability. From creating the rent roll to maintaining and analyzing it, this document is crucial for effective property management. Maintaining an accurate and up-to-date rent roll is crucial for maximizing the profitability and efficiency of rentals.